Vat Monitoring

In the 2016 Budget announcement, the Minister for Finance has announced the introduction of the Environmental Levy (EL) that reinforces Government’s commitment for all Fijians the right to a clean environment. The levy would mostly be applicable to Visitors that come for the luxury of the accommodations and the natural beauty and recreational opportunities in Fiji, and they will have to pay a small additional charge to support environmental protection programmes.

The Environmental Levy will be levied at the of rate 6% on the ‘turnover’ of prescribed service providers effective from 1st January 2016 or in other words Environmental Levy must be charged or levied on prescribed services listed under the Schedule of the Environmental Levy Act. ‘Turnover’ means the total charges for prescribed services billed to consumers.

Who is an Accountable Person?

Vat Monitoring

In the 2016 Budget announcement, the Minister for Finance has announced the introduction of the Environmental Levy (EL) that reinforces Government’s commitment for all Fijians the right to a clean environment. The levy would mostly be applicable to Visitors that come for the luxury of the accommodations and the natural beauty and recreational opportunities in Fiji, and they will have to pay a small additional charge to support environmental protection programmes.

The Environmental Levy will be levied at the of rate 6% on the ‘turnover’ of prescribed service providers effective from 1st January 2016 or in other words Environmental Levy must be charged or levied on prescribed services listed under the Schedule of the Environmental Levy Act. ‘Turnover’ means the total charges for prescribed services billed to consumers.

Who is an Accountable Person?

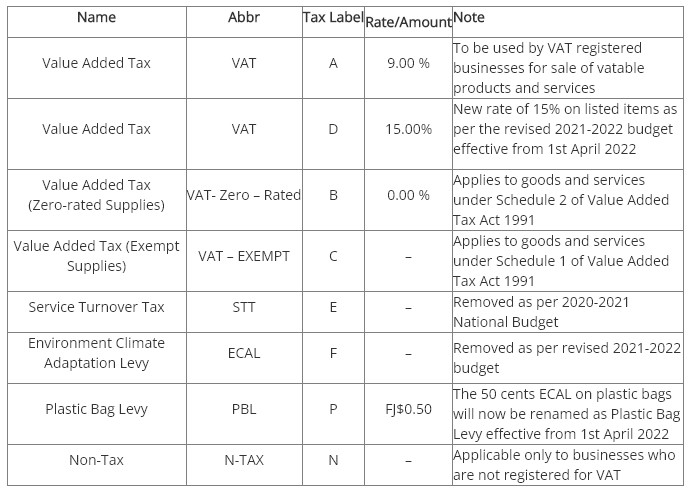

Tax Labels 2022 Mini Budget